Have you heard about matching gifts? Do you know how much they can affect your nonprofit’s fundraising?

More importantly, do you want to potentially double the amount of money your nonprofit brings in from individual donations?

Matching gift programs might be the perfect solution for you!

This article will take you through the following questions:

- What are matching gifts?

- How can matching gifts affect your nonprofit?

- What’s the upshot for matching gifts?

Let’s get started!

The most obvious way that matching gifts impact your organization is the fact that they provide you with extra fundraising revenue.

However, there are a couple of other benefits that come with matching gifts.

A. Better relationships with donors

Donors do not appreciate being asked for a second contribution shortly after giving to a nonprofit. When this happens, donors are unlikely to make another gift and they end up feeling more like ATMs than actual people.

With matching gift programs, your nonprofit can ask for another donation without asking a donor to open their wallet a second time.

This means that your organization (potentially) receives twice as much money without injuring a donor relationship by asking them for another donation.

B. Stronger corporate partnerships

Corporations contribute a significant portion of their funds to nonprofits each year. As time goes by, companies are focusing more and more on their corporate philanthropy and corporate social responsibility (CSR) efforts.

While matching gifts are just one of the many types of corporate giving programs, they can help your nonprofit form stronger corporate partnerships.

The more contact your organization has with philanthropic businesses, the greater chances you have at:

- Receiving in-kind donations

- Receiving sponsorships

- Encouraging teams of corporate volunteers

- Being eligible for corporate grants

- Receiving other types of corporate funding

Matching gifts are a good first step into the world of corporate giving programs. The more you promote them to your donors, the more likely you’ll be to form even stronger corporate partnerships.

The bottom line: Matching gifts aren’t just double the funding! They can also improve your relationships with donors and help you forge and strengthen corporate partnerships.

Matching gifts are a type of corporate giving program. They essentially double a single donation to your nonprofit.

Here’s how they work:

- A donor makes a contribution to your nonprofit (either by mail, over the phone, through your online giving page, or via another method).

- The donor submits a matching gift request (either via a paper form or online) to their employer’s HR department.

- The company will review the donation and determine your nonprofit’s eligibility (some companies only donate to certain types of charities).

- If eligible, your nonprofit will receive a check from the company for the same amount as the initial donation.

Let’s run through some of the more specific details about matching gifts.

Donation and nonprofit eligibility

Most nonprofits will match standard, cash donations. Typically, in-kind donations are not eligible, but in some cases, companies will match a technology or software donation that someone makes to a nonprofit. For example, HP will match in-kind donations of HP technology.

Additionally, companies have guidelines for the types of nonprofits or schools that are eligible to receive matching gifts. Typically, churches or religious organizations do not qualify. In some instances, a nonprofit may need to produce proof of its 501(c)(3) status before a matching gift can be received.

Matching gift ratios and minimum and maximum amounts

Most companies will match donations at a standard 1:1 ratio, doubling an employee’s donation. However, some businesses have match ratios that go as high as 3:1, which quadruple an employee’s contribution!

Oftentimes, the matching gift ratio will depend on a donor’s status within the company (employees will typically be eligible for a higher match ratio than retirees, for instance).

Many companies also institute a donation minimum (typically between $25 and $50), although companies like Apple will match contributions as small as one dollar!

Every company that matches gifts also has a maximum amount per employee that they will match per year. These caps can range from $1,000 to $100,000.

Employee eligibility

Nearly every company that has a matching gift program will match full-time employees’ charitable donations.

However, some of these businesses also extend their matching gift programs to:

- Part-time employees

- Retirees

- Spouses of employees and retirees

- Board members

It is up to employees to know their matching gift eligibility status.

Deadlines and paperwork requirements

Each matching gift program has a different deadline. Some companies require paperwork within 3 months of a donation.

Other businesses will give employees until January or February of the year following the donation date to make their matching gift submissions.

Additionally, some companies will only accept paper or digital form submissions (although many will accept both).

This means that donors who submit year-end gifts might be able to have their contributions matched by their employers!

What’s the bottom line? Matching gifts are a great opportunity to potentially double your nonprofit’s fundraising revenue. As long as you’re aware of deadlines, restrictions, and guidelines, you can accurately promote matching gifts to your donors to encourage them to submit their requests on time.

You may have noticed, but we’ve mentioned “promoting matching gifts to donors” in both of the previous sections.

The reason behind this is simple: many of your donors just don’t know that their employers offer matching gift programs.

And if they do know about these programs, they might be unaware of the deadlines, requirements, and paperwork that we discussed earlier.

It is, therefore, up to your nonprofit to spread the good word about matching gifts and encourage your donors to submit their requests in a timely manner.

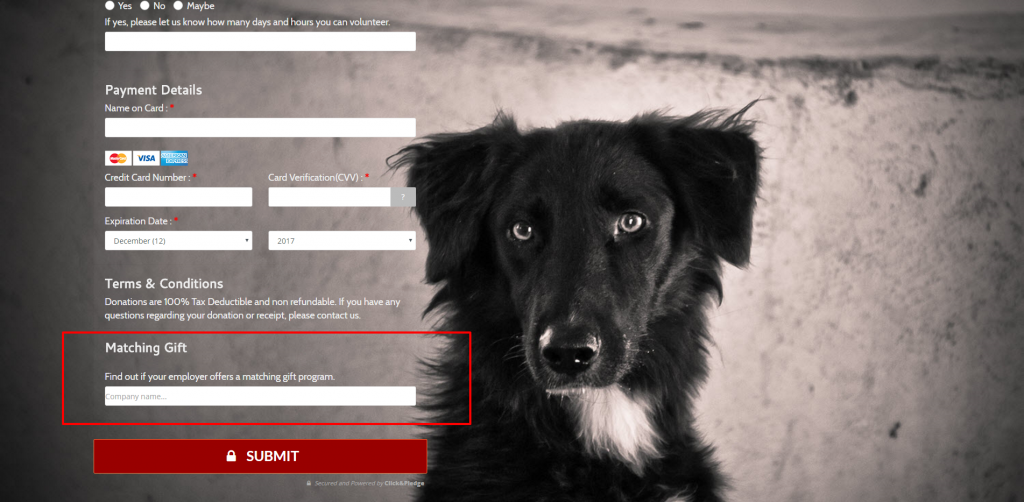

If you use Click & Pledge and/or Salesforce®, you might have access to Double the Donation’s matching gift software.

According to the integration guide,

Click & Pledge and Double the Donation have teamed up to offer matching gift functionality within Click & Pledge’s donation forms and Salesforce donor management system.

This means that when your donors use a Click & Pledge donation form, they will be able to look up their company’s matching gift program using an easy-to-use tool. (You can read more about the integration here or here.)

You can promote matching gifts to your donors in other ways, though! Below are just a few suggestions for matching gift promotion methods:

- On your “Ways to Give” page

- On a dedicated “Matching Gifts” page

- During fundraising events

- In direct mail inserts

- On donation confirmation screens

- Within acknowledgement letters and emails

- During phone calls and in-person meetings

The bottom line: The more informed your donors are about matching gift programs, the more likely they will be to submit match requests to their employers.

Matching gifts can be a fundraising blessing for your organization. However, it helps to know the ins and outs of this corporate giving program.

If your nonprofit effectively promotes matching gifts to your donors, you have the potential to double your fundraising revenue!